Industries with the most to lose after COVID-19

One thing that news channels, politicians and the general public have been unanimous on over the past three years has been that the pandemic has been bad for business.

Posts about:

One thing that news channels, politicians and the general public have been unanimous on over the past three years has been that the pandemic has been bad for business.

Market watchers have seen a growing divergence over the last decade between share price and the “fundamental” value of the companies behind the stock charts. These major companies are artfully bridging the gap between what the financial picture today says they are worth and what they could be worth in the future.

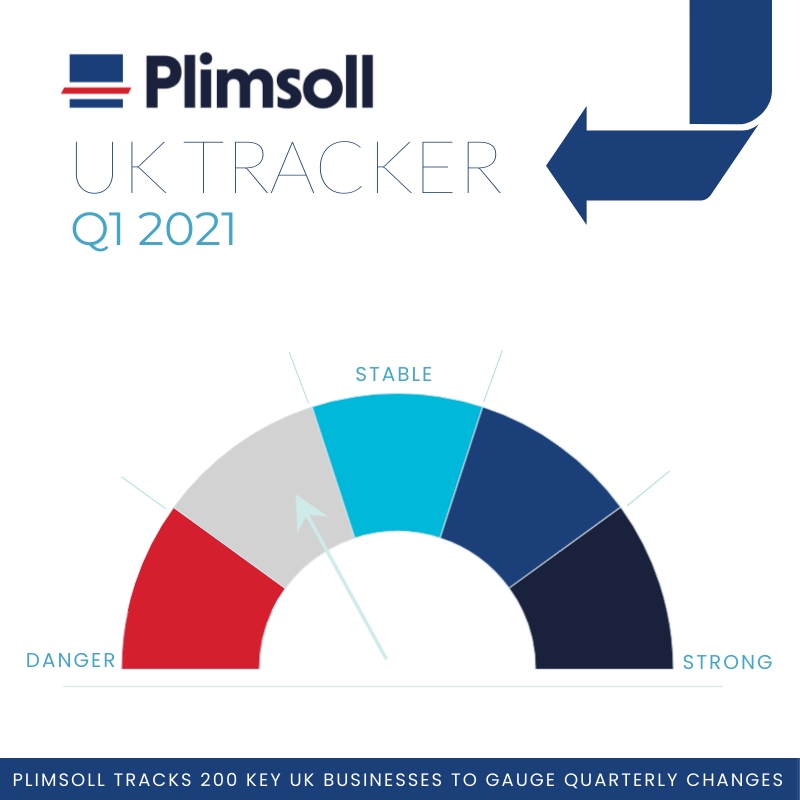

Based on more than three decades of research and development, the Plimsoll Model provides a graphical measure of any company’s current, overall financial health, and the trend in that health over the preceding four years. Plimsoll produces over 1600 individual market studies and rates each company included as Strong, Good, Mediocre, Caution or Danger.

New research into the financial performance of the UK Fresh Produce sector has revealed how the industry’s top companies have performed throughout the last 12 months.

It’s almost 25 years since Alan Greenspan coined the phrase “irrational exuberance” to warn of the potentially overvalued nature of some stocks in the mid-90’s, right before the dot-com bubble burst. As today’s world economy grapples with trading conditions incorporating a global pandemic, an ever-shifting geopolitical landscape and the growing perils of climate instability, is there irrational exuberance in share prices or is it really different this time?

The vaccines are working. The kids are going back to school. The road map back to a more normal life has been laid out by the Prime Minister. With that in mind, what better time to draw a line in the sand and review and assess what impact COVID-19 has had on some of UK PLC’s bellwether, major companies?

New research from global market analysts Plimsoll Publishing Ltd has identified 22 inspirational companies who are prospering within the UK Fresh Produce sector.

British clothing retailers have been hitting the headlines in recent months, among store closures and claims that sales have “fallen off a cliff”, the sector certainly seems to be going through a difficult time.

Zombie companies have been kept afloat by cheap money and favourable governance over the past decade and a half. The economic crises from the ‘Great Recession’ that followed the 2008 financial crash, to the impact of Brexit and onto the pandemic, didn’t force as many companies out of business as a normally would have been expected.

The UK’s 200 leading companies continue to be a bellwether by which to measure the health, global reach, and economic outlook of the nation. Crises erupt and abate but UK Plc’s largest businesses persist, adapt and are a constant measure of economic stability.