Will the twin threats of labour and material shortages burst the UK’s construction boom?

Click here to find out more about the latest Construction analysis.

“Build back better” has become the punchline to an uncomfortable joke for the UK’s leading construction companies. The reality facing the market is wildly different to the latest glib, a three-word slogan from the HM government. Two main crises are placing unprecedented pressure on all aspects of the trade.

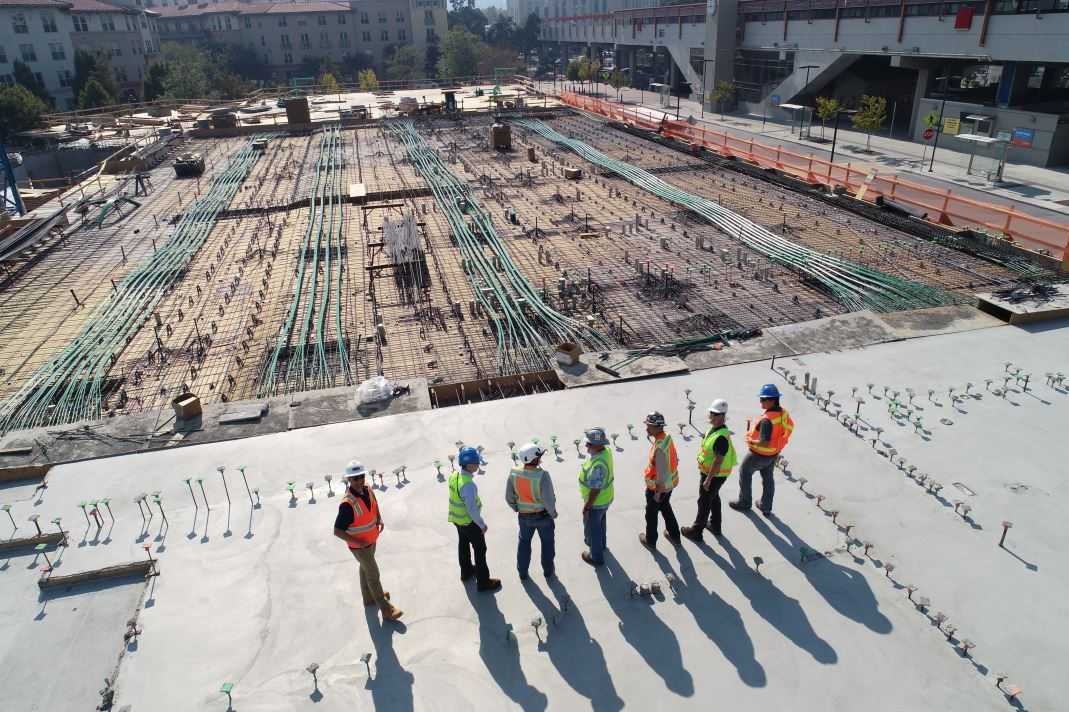

Projects are stalling across the country, as the labour shortage crisis grows more acute. Post-Brexit, the supply of skilled labour in the construction sector is reaching a critical point and there is no short term, the simple solution on the horizon. From bricklayers to carpenters, electricians to plasterers shortages are growing, day rates are rising and the market is creaking.

Elsewhere, the material shortage shows few signs of abating. Concrete, timber, steel, bricks and just about every other building material continue to be in short supply. Timber is up 23% in one month for example and while supplies have increased in the past week or two, the lack of haulage capacity means getting material to sites continues to be compromised.

With the market facing such a perfect storm, that is likely to persist for some time, the latest Plimsoll Analysis has vetted the financial health and outlook of the UK’s 1500 leading chemical companies. Based on the latest data, this interactive analysis of the market shows:

- 138 companies were rated as Danger and in serious financial danger

- Profit margins have averaged around 3% but fell sharply in the latest year

- Sales growth in the market was down to 2% but a healthy 5% pre-pandemic

- 232 companies have seen their debt position deteriorate in the latest year

The Plimsoll Analysis provides an instant assessment of the health and sustainability of the UK’s 1500 leading construction companies. It provides advanced warning of who is most likely to survive the supply crisis and who could fail.

For construction companies, it provides an instant benchmark of your performance against the rest of the UK market and the insight you need to develop your strategy for 2022. For observers and suppliers in the market, it will show you which companies are in a weakened position and most at risk of failure.

The UK’s construction companies are right to be drawing up plans to cope with the ever-evolving crises facing the market. The economic case for continuing to build is being sorely tested by unsustainably high energy, material and labour prices. The Plimsoll Analysis reveals the companies most likely to be standing at the end of what could be a very difficult winter.

More information about the Plimsoll Analysis on the UK construction market is available here.