The Plimsoll Tracker – taking the pulse of UK Plc

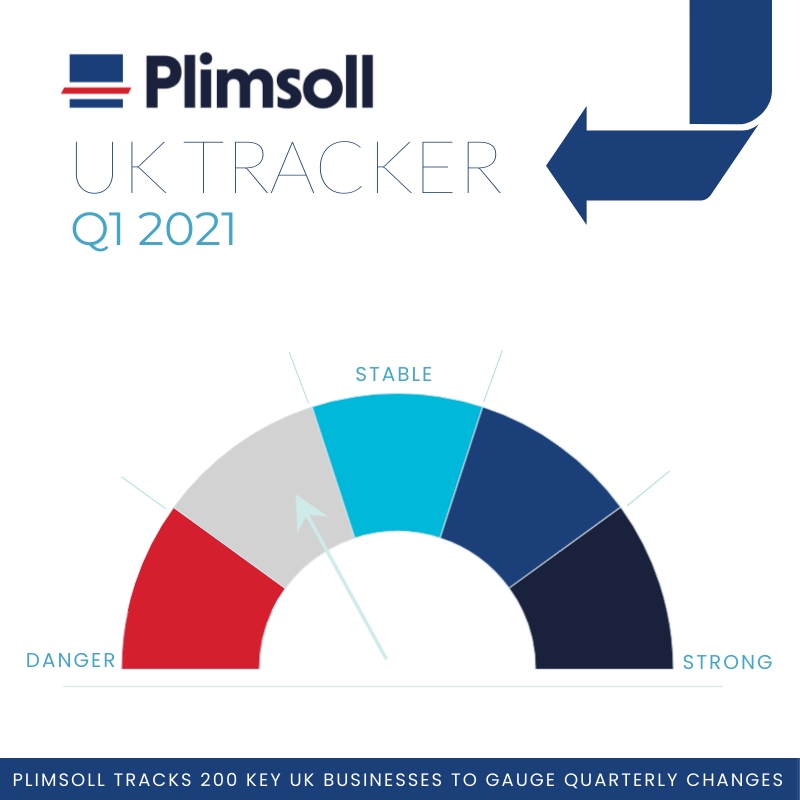

The latest quarterly Plimsoll Tracker is starting to reflect the deep impact the first wave of COVID-19 has had on the UK’s bellwether PLC’s by which we measure the health, global reach, and economic outlook of the nation.

The Plimsoll Tracker measures the quarterly performance trends of the UK’s 200 leading, non-financial companies to assess their resistance to shocks and how much they are adding back to the nation through tax, employment and remuneration.

Each quarter Plimsoll examine three performance measures, based on the latest financial data of the UK’s top 200 companies – people, performance, and pressure. The first will examine the number of jobs lost or added and the fluctuations in pay and productivity. The second looks at financial stability and outlook. The final area examines debt position and the overall health of the top 200 companies.

This latest quarterly bulletin from the Plimsoll Tracker highlights the latest intelligence on these British commercial heavyweights. Here are the key findings:

In the latest Plimsoll Tracker, we are seeing the extent to which jobs are being shed among the UK’s largest firms. 199,000 fewer people are employed which is a 3% reduction in overall staff numbers. This has seen a correlated 3% decline in salaries paid while average salaries paid has remained stable at £38k per person employed.

As government support is gently removed from the economy and the impact of Brexit begins to work through the system, how many of these roles will return or will the declines accelerate? Productivity is already down 12% quarter on quarter and with the effect of an elongated period of lockdowns and disruption still to be fully felt, many of these major companies could be mindful of how many roles they bring back.

Decisions on how many roles to bring back could be accelerated if the forecast spike in inflation becomes more ingrained. If wage expectations rise in line with price inflation, it will add pressure for large companies to trim headcount to control cost and productivity. “Fire and rehire” had been a simple route to reducing people costs but as that becomes increasingly political major companies will have to make the decision to reduce headcount or find efficiency gains elsewhere.

More than half of the top 200 companies have seen their sales fall. 111 in total have posted a decline in revenue in their 2020 accounts. Taking a more positive view of the situation, that means that 89 of the UK’s largest PLC’s, in the face of the biggest health crisis for a century, have managed to grow.

Of more concern is the trend in profit. Average profit margins have plummeted 72% in a single year fall not seen since the Great Depression as companies, even those dominant in markets that flourished during the initial pandemic, struggled to operate profitability.

The social consequence of that decline is the exchequer has seen tax income for HM Government from the UK’s largest companies halved in the latest year. The loss to the public purse is almost £17 billion, which equates to around 10% of the NHS budget or just under half the education budget.

A growing debt burden is putting further pressure on falling margins and as a result, dividends are down 22% in the latest year dealing a further blow to pensions and investors. Any tightening of monetary policy in the near to mid-term will further squeeze profitability.

For more than 30 years, Plimsoll has been rating the financial health of companies of all shapes and sizes around the world. 9 out of 10 companies currently in administration were rated as “Danger” by Plimsoll up to two years prior to their demise. Size doesn’t protect a company from its ultimate demise, but it can elongate the process.

As a result of the sales and profit squeeze from COVID-19 and possibly even Brexit disruption, debt levels are rising among the UK’s Top 200. Short-term debt has risen 9% whereas long-term debt is up 16% and, as a result, interest payments have ballooned by 14% in the latest year.

The debt commitments many companies have accumulated have been used to bridge the crisis rather than invested in assets and productivity gains. As a result, overall financial health is starting to sag. There has been a 24% decline in overall financial health as measured by the Plimsoll Model leading to a sharp rise in companies rated as Danger.

Summary

The 200 companies used as part of the Plimsoll Tracker cover almost all non-financial sectors of the economy from retail to agriculture. The latest quarterly updates are the first to reflect the impact of the COVID-19 pandemic. On average sales are falling, profits have plummeted, debts are increasing, and overall financial health has dipped considerably.

With the country still under lockdown restrictions and the effects of Brexit only now becoming clearer, how soon can these bellwethers of the UK economy get back to health or are they a portent of the economy still to come down the line for the rest of the economy?

As the labour market becomes increasingly tighter as Brexit chokes off the supply of cheap human resources, and inflation builds further in the system, how many of the UK’s major companies can trade their way back to health?

About Plimsoll

Plimsoll produces 1600 individual studies on key markets in the UK economy. We specialise in assessing company performance, valuing companies, spotting undervalued acquisition targets, and looking for opportunities in new markets.

Operating since 1987, we are the UK’s leading provider of instant analysis and easy to understand business intelligence. If you are looking to perform better than your peers, looking for intelligence on acquisition opportunities, searching for growth markets or just want to make better business decisions, Plimsoll has a solution for you.

To find out more about how we can help you to understand more about your markets, please click here to search for your industry today